In last week’s blog, as we launched CORD 4.1, we discussed how CORD’s latest release now combines residential, enterprise and mobile subscriber support into one platform, while also packaging 25 VNFs into the single distribution. This is both simple and powerful.

Now we want to look outward and share some thoughts on the size and scope of the opportunity. How big is it and who is involved? Deploying agile services with resource intensive applications at the edge of the network is the name of the game, and CORD is evolving into a powerful platform with a range of capabilities to enable new edge services while reducing costs and meeting latency requirements.

As for the opportunity - think big and diverse. CORD is supported by a wide ranging ecosystem of global carriers and vendors ranging from software developers to white box and networking suppliers. And of course, the system integrators (SIs) who put it all together.

Big is Really Big:

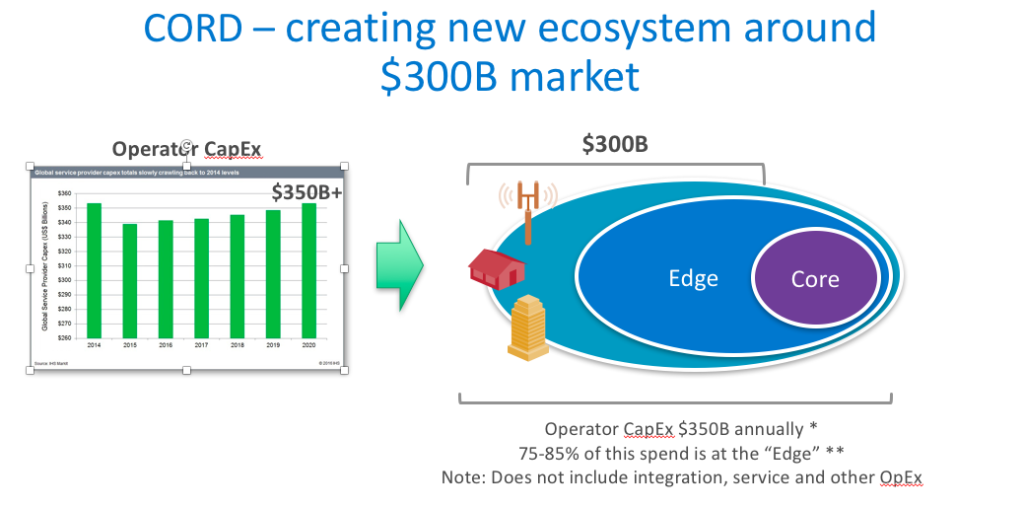

CORD is impacting a market in the neighborhood of $300B annually. This is because Global Operator CapEx is approximately $350B annually* and approximately 80% of this spend is at the edge. Additionally, 70 percent of respondents to a IHS Markit survey plan to deploy CORD in their central offices (COs). With CORD, the market is in its early formative stages and this is the time for companies to position themselves for this massive emerging opportunity.

The Diverse CORD Ecosystem

With CORD fast becoming the de facto open source platform for the operator edge, the list of companies participating in CORD is becoming a “who’s who” of operator networking — including service providers, vendors and system integrators. The players are beginning to come together to represent every aspect of service delivery, hardware, software, services and testing. Here is a taste of the spectrum of companies who are active with the ONF and with the CORD project:

Global Carriers engaged in CORD

AT&T, BT, CenturyLink, China Unicom, China Mobile, Colt, Comcast, DT, Google, NTT, Reliance Jio, SK Telecom, Sprint, Telecom Italia, Telefonica, Telstra, Turk Telekom & Verizon

-- Incumbent Vendors:

Cisco, Ericsson, Fujitsu, Huawei, NEC, Nokia, Samsung

Integrators:

Argela/Netsia, Ciena, Flex, Radisys

-- Silicon Manufacturers:

ARM, Broadcom, Cavium, Intel

-- Proprietary VNF Vendors:

Akamai

-- White-box Specialists:

Delta, Edgecore, QCT

These are just a few of the 160+ member companies working with the ONF on this transformational journey.

Call Out to VNF Vendors:

VNF vendors have struggled to date. The lack of a standard NFVI platform, and standard NFV MANO (management) has made it very difficult for smaller VNF vendors to know what environment to target with their products.

CORD is now providing a de facto open source solution for both these vital components. CORD provides the complete NFVI platform, and CORD’s XOS orchestration delivers an innovative cloud-native MANO solution. All this in an integrated platform.

If you are an VNF vendor - you need to check this out. Case-in-point - Akamai bundles a closed-source VNF with the CORD distribution, making Akamai CDN services available as part of any CORD design. Onboarding a VNF is greatly streamlined in CORD 4.1. One writes a model to describe the VNF, and some synchronizer code to support activation. The CORD platform takes it from there.

Don’t Wait:

Now is the time for companies to get involved. This is a unique moment when you can help shape the ecosystem that will serve this $300B market. The ONF is a non-profit. We can’t possibly do this on our own. We need motivated companies that share our vision, want to work with our operator partners and are excited to join with our community as we go about transforming this market.

CORD has gained fantastic traction in 2017. It is hard to believe the first release was just 18 months ago. And looking forward, you can expect exciting developments next year as CORD addresses the biggest challenges facing operators - innovating at the network edge.