What an amazing week we had.

Last week our community came together in force at ONF Connect’19, and it was inspiring to see the tremendous progress that has been made over the last 9 months since the first incarnation of the event. One significant takeaway for me was just how much further along we are towards operators deploying solutions based on SDN/NFV/Cloud architectures leveraging whiteboxes and open source, and how this progress is translating into new business opportunities. I thought I’d share some of the things that struck me most ...

Comcast in Production with Trellis and ONOS

A capstone for the event was Comcast announcing Trellis is in production supporting live customers as Comcast builds out their next generation access network. Trellis is providing significant advantages for them (cost, space, power, flexibility, self-determination, etc.). But it’s important to note this also implies vast cultural and process changes where Comcast is demonstrating for the industry how to build and deploy solutions in this new era of open source and white boxes. Comcast worked through issues like procurement and support, and they have shown how to take on the historical view that operators require two years of testing and hardening and an incumbent to serve as a single ‘throat-to-choke’.

Hear directly from Comcast on their open source journey and where and how they are using Trellis in production:

Comcast’s Production Deployment

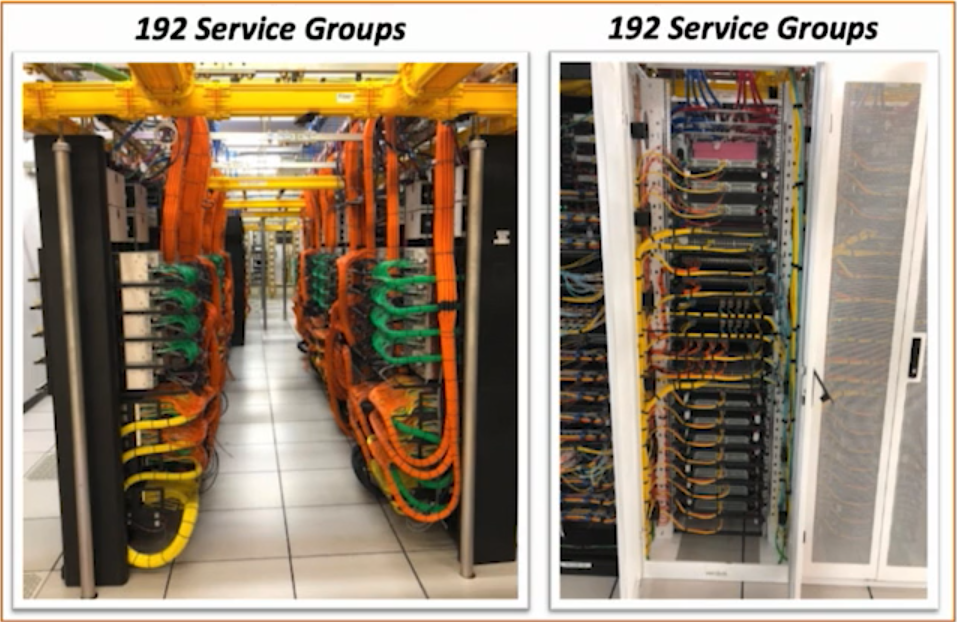

And if a picture is worth a thousand words - here’s one. The power of disaggregation, white box, open source, SDN and cloudification is demonstrated here in a before-and-after snapshot:

Why does this matter. Look just at the space savings - the left is the old way Comcast built access solutions, and the right is a single rack serving the same number of their customers with their new access network.

It is clear the transformation is taking shape, and that Trellis and ONOS are production-ready post trials, scaling and refinement to get to this point. Hats off to Comcast for charting a course that other operators can follow.

Supporting Ecosystem

This new era of open source is enabling a transformative breed of supply chain to take shape. New classes of vendor are stepping up to work collaboratively with operators to help deploy open source based solutions in ways that benefit all parties involved. Vendors build new revenue streams by offering integration services, custom software development or supplying hardware components, and multiple vendors may work collaboratively with operators in a new style of open ‘distributed DevOps’ where a virtual teams are formed with participation from all stakeholders.

Two such vendors, Edgecore and Infosys, discussed both the challenges and the tremendous opportunity of building business and serving operators in this new open source era. Hear more from them (and on the full Trellis solution) in this video clip:

On the Cusp of a Massive Transformation

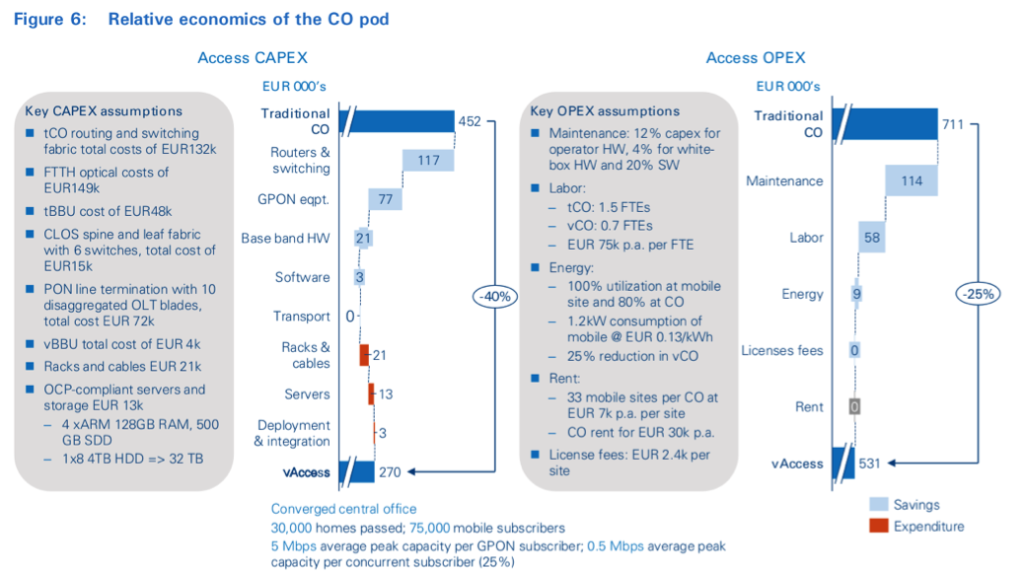

Another highlight was ADLittle publishing a report along with AT&T, DT and Telefonica on the transformation taking shape at the edge of the network with the ‘Cloud CO’. This comprehensive report provides extensive and detailed insight into how these operators are all using a common open source platform to deploy customized solutions to meet each of their unique needs. It is fascinating to see these operators working together and sharing publicly such intimate details of their architectures, plans and knowhow.

details on the how and why of using

CORD to transform the edge of the carrier network

I predict this report is poised to have an impact similar to AT&T’s original Domain 2.0 paper. If you are an operator considering deployment of CORD-like solutions, this is a must-read paper that will help you craft and chart your course forward.

discuss the report and implications for the industry

One key takeaway to whet your appetite and encourage you to dig deeper into the report: CORD provides 40% capex and 25% opex savings for operators:

Total Market Size for Open Source Related Solutions

With all this notable traction, it’s not surprising that the investment community is starting to take notice. We often hear that ‘open source isn’t free’, but it is becoming clear that the work of ONF is transforming markets and creating opportunities for new and existing players alike. We are seeing transformation in an industry that has been marked by ossification for years.

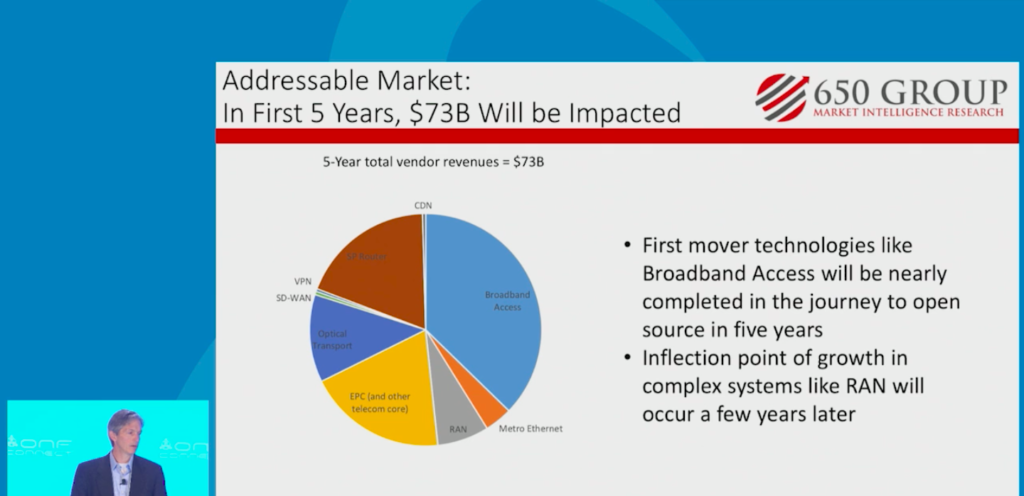

It was great to hear from an innovative analyst who has taken note of this transformation and who has just completed extensive research forecasting the total market that will be impacted by ONF and CORD related open source platforms. Spoiler alert - $73 billion is a big number.

Chris discusses this and shares many more insightful takeaways to help those of you looking to build a business around open source.

650 group projects $73B is spend will shift as a result of ONF’s work

… and More

That’s a lot, but I’ve really summarized just the Industrialization takeaways from ONF Connect. We also witnessed significant updates in other areas, including:

- Next-Gen SDN

- Mobile and 5G activities gaining tremendous traction

- Sprint and T-Mobile taking ONF’s OMEC Mobile Core to production

- A new ONF SD-RAN open source platform being demonstrated at Connect’19

I’ll write more on these other important updates elsewhere after I’m a bit further along recovering from last weeks’ whirlwind event. Until then ...